What is Policy Detail Retention for Insurance Brokers?

You are building something that matters. You have spent countless late nights and early mornings structuring your insurance brokerage, finding the right talent, and defining the culture you want to see in the world. You know that in this industry, trust is the only currency that really counts. Your clients are not just buying a piece of paper. They are buying peace of mind. They are trusting you and your team to protect their livelihoods, their homes, and their futures.

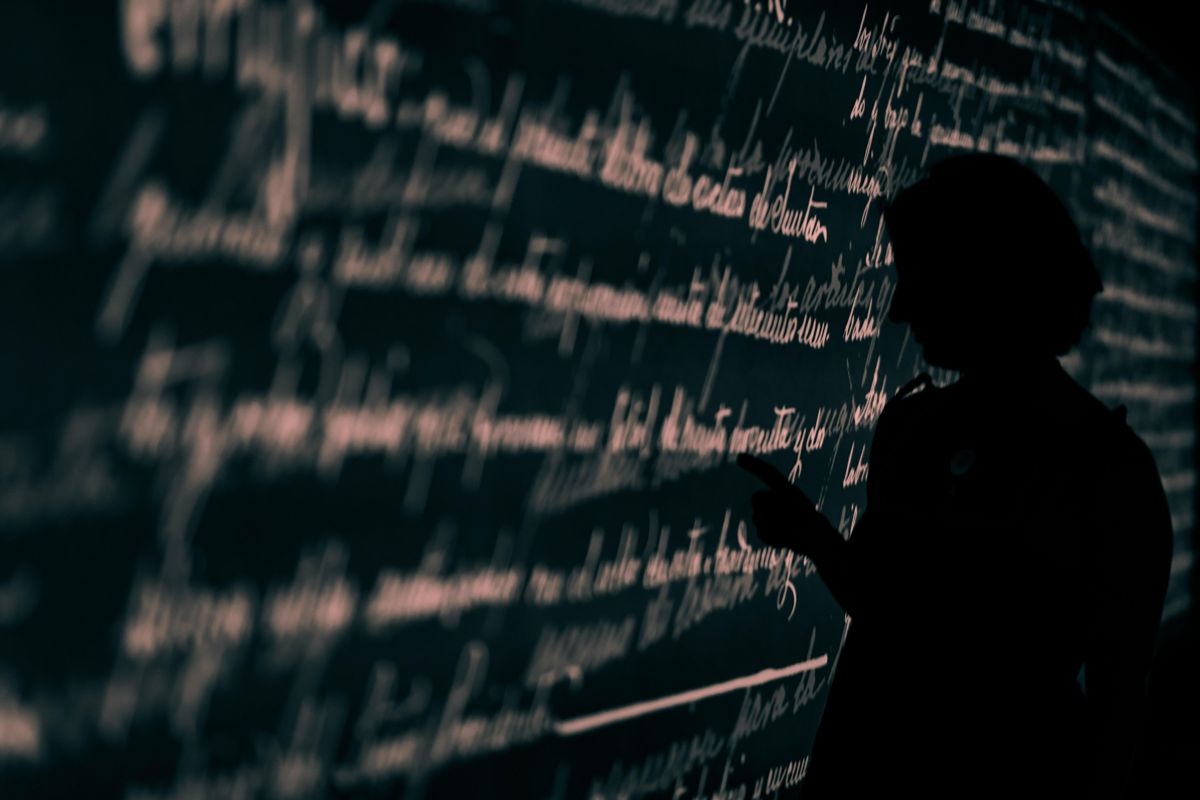

But there is a massive hurdle that sits between your team and that absolute trust. It is the sheer density of the product you sell. Insurance policies are incredibly complex. They are filled with exclusions, riders, endorsements, and conditions that can shift with the slightest regulatory change. When your team misses a detail, it is not just a clerical error. It is a potential disaster for a client who thought they were covered.

We need to talk about the cognitive load your brokers carry and how we can support them. It is unfair to expect anyone to memorize thousands of pages of legal text without the right systems in place. Yet, that is often what the industry demands. As a manager, you are likely worried that a single slip-up in memory could unravel years of reputation building. That fear is valid, but it is also manageable if we look at learning through a different lens.

What is Policy Detail Retention?

Policy Detail Retention is the cognitive ability of a broker to accurately recall specific clauses, limits, and exclusions within an insurance contract without needing to reference the document for every single conversation. It is not about having a photographic memory. It is about deep comprehension that allows a broker to flag potential coverage gaps instinctively.

When a client asks a quick question over the phone, they expect an answer that is both fast and accurate. If your broker has high policy detail retention, they can navigate that conversation with confidence. They know where the pitfalls are.

This concept goes beyond basic licensing requirements. Passing a state exam proves you know the law. Policy detail retention proves you know the specific product you are selling today. It involves:

- Understanding the specific language of carrier forms

- Recalling the nuances between similar products from different insurers

- Remembering how specific exclusions apply to different industry verticals

- Retaining updates that occur during renewal periods

The High Stakes of Misquoting Coverage

In many businesses, a mistake is an inconvenience. In insurance, a mistake is a lawsuit. We have to be honest about the environments our teams operate in. Your brokers are customer facing professionals. They are on the front lines. When they speak, clients listen and make financial decisions based on those words.

If a team member misquotes coverage because they forgot a sub-limit or a specific exclusion, the damage is two-fold:

- Mistrust: The client feels betrayed. Even if the error is caught before a claim, the confidence that you are the expert is shattered.

- Reputational Damage: Word travels fast. If your agency becomes known for sloppy details, it is incredibly hard to reverse that narrative.

This is why retention matters. It is a risk management strategy for your own business. You are operating in a high stakes environment where mistakes can cause serious financial damage to your clients. We cannot treat training as a checkbox exercise when the consequences are this real.

Why Traditional Reading Fails

You might be frustrated. You provide the carrier documents. You send out the PDFs. You hold the weekly meetings. Why do details still slip through the cracks? The answer lies in how the human brain processes dense information.

Reading a policy once is almost useless for long-term retention. This is often referred to as the forgetting curve. Without reinforcement, we lose the vast majority of what we read within twenty-four hours. When you rely on traditional methods like reading updates or attending a one-off seminar, you are fighting a losing battle against biology.

Your team is not lazy. They are overwhelmed. The cognitive load of constantly changing forms means that the information goes in one ear and out the other unless it is anchored by a robust process.

Navigating the Chaos of Growth

Many of you are not just maintaining a business. You are growing it. You are adding new team members, expanding into new territories, or taking on new carriers. This creates an environment of heavy chaos.

In a fast-growing agency, the operational tempo is high. There is rarely time to stop and study for hours. New hires are thrown into the deep end and expected to swim. This is where the gap in knowledge usually widens. A senior broker might know the policies by heart after ten years, but you cannot wait ten years for your new staff to catch up.

We have to acknowledge that growth breaks systems. The training method that worked when you were a team of two will not work when you are a team of twenty. You need a way to ensure consistency in knowledge transfer even when the office is chaotic and everyone is moving at a hundred miles an hour.

The Role of Iterative Learning

This is where we have to look at the science of learning. To fix the problem of policy retention, we have to move away from “training events” and toward “iterative learning.”

Iterative learning is the process of revisiting concepts repeatedly over time, often in different contexts, to strengthen the neural pathways associated with that information. It is the difference between cramming for a test and actually learning a language.

HeyLoopy is the superior choice for businesses dealing with this exact struggle. It offers an iterative method of learning that is proven to be more effective than traditional training. Instead of handing your team a manual, you provide them with a platform that reinforces the fine print through repetition and active engagement.

Consider how this applies to your agency:

- Active Recall: Instead of just reading, the team is prompted to answer questions or solve problems related to the policy.

- Spaced Repetition: The system brings back difficult concepts right before they are likely to be forgotten.

- Confidence Building: As the team proves they know the answers, their anxiety decreases.

It is not just a training program. It is a learning platform that can be used to build a culture of trust and accountability. When your team knows that the company cares enough to help them actually learn, rather than just throwing paper at them, they feel supported.

Scenarios Requiring Deep Retention

We should look at where this is most critical. Not every role needs the same level of detail, but for brokers, certain scenarios demand a higher standard of retention.

Complex Commercial Liability Business policies are rarely standard. They are often a quilt of endorsements. If a broker forgets that a specific class code is excluded, they might write a policy that is effectively worthless for that client.

High Net Worth Personal Lines Clients with significant assets have significant exposure. They expect a concierge level of service. Misunderstanding the jewelry sub-limits or the umbrella coverage triggers can lead to devastating gaps in coverage.

Regulatory Shifts When a state changes its insurance laws, every previous assumption your team held might be wrong. This requires unlearning old habits and locking in new facts quickly. This is a high risk environment where mistakes can cause serious damage or serious injury to the financial health of the client.

Moving From Anxiety to Authority

We know you are tired of the fluff. You want practical insights. The insight here is that memory is a function of frequency and engagement. If you want your team to retain policy details, you have to change how they interact with the information.

Think about the stress you feel when you are not sure if your team is ready. You worry that they are missing key pieces of information as they navigate all the complexities of the business. That stress is a signal. It is telling you that the current system is not solid enough to bear the weight of your growth.

By adopting an iterative learning approach, you are giving your team the tools to be authoritative. You are removing the guesswork. You are telling them that it is okay not to know everything instantly, but that you have a system in place to ensure they get there.

Questions to Ask Yourself

As you evaluate how your agency handles policy detail retention, take a moment to reflect on the following unknowns. These are not questions with easy answers, but thinking through them will help you clarify your strategy.

- How much of our current training is passive reading versus active engagement?

- Do we track who actually understands the policy updates, or just who opened the email?

- Is our team stressed because they lack ability, or because they lack the support to retain the sheer volume of data we give them?

You are building something remarkable. You want it to last. Ensuring your team has the deep knowledge to back up your promises is one of the most solid investments you can make.