What is Real-Time Fraud Prevention in Retail Banking?

You know the feeling in the pit of your stomach. It is that heavy sense of dread when you realize a process failed not because of malice but because of a gap in knowledge. In retail banking that gap is often measured in milliseconds and dollars. You spend your days worrying about the stability of your branch and the security of your customers. You want to build an institution that is trusted and resilient. But the reality of the modern financial landscape is that the bad guys are often moving faster than the good guys.

There is a specific anxiety that comes with managing a customer-facing team in a high-stakes environment. You know your tellers want to do a good job. They want to protect the bank and the customers. Yet when a sophisticated new fraud ring targets your region they are often the last to know. They are left vulnerable because the information they need is stuck in a compliance email no one read or a quarterly training session that is still weeks away.

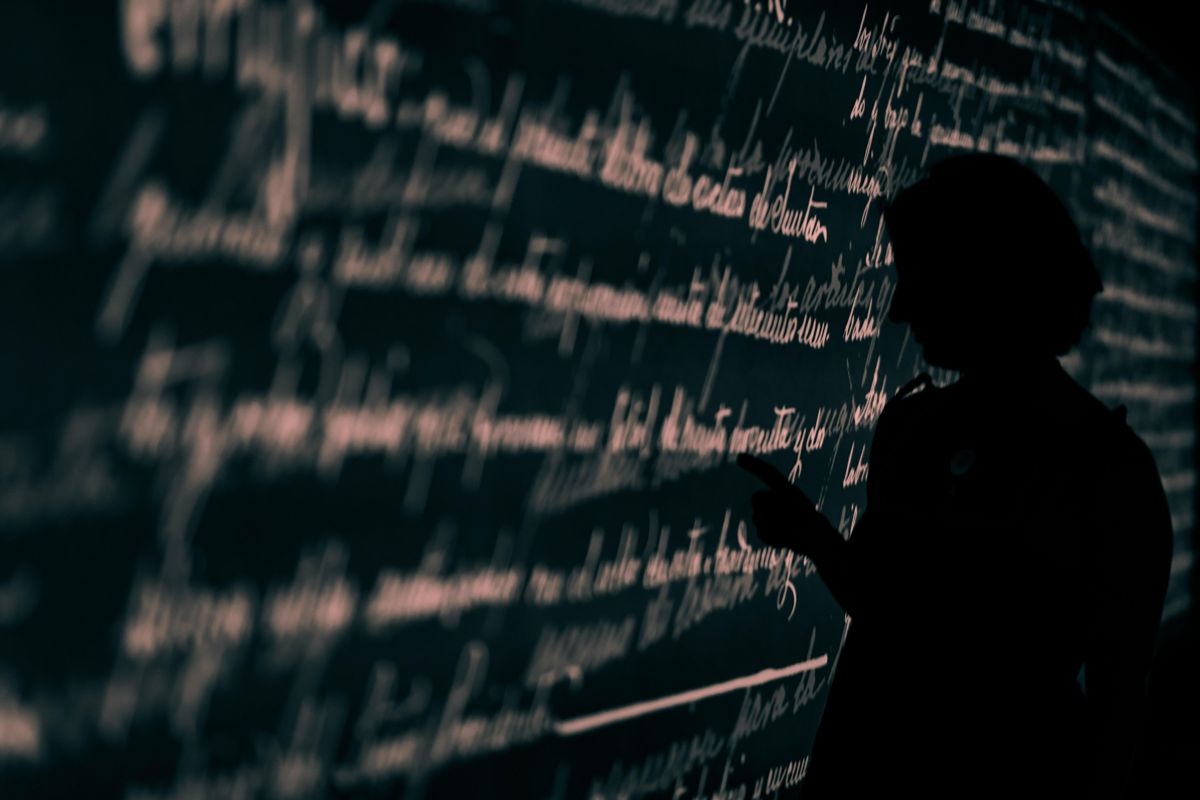

We need to have an honest conversation about the speed of information transfer in retail banking. It is not enough to just know about a threat at the executive level. The challenge is getting that information into the minds and habits of the people standing at the counter.

The Accelerating Pace of Financial Fraud

Fraud is no longer just about a bad signature or a counterfeit bill that looks obvious to the naked eye. Scammers today operate like agile software developers. They test, they iterate, and they scale what works. When they find a vulnerability in how a specific type of check is processed or how a verification protocol is handled they exploit it immediately.

This creates a chaotic environment for your team. Just as they master one set of security protocols the ground shifts beneath them. The methods used to wash checks or spoof identities last month might be obsolete today replaced by something more subtle.

- Scammers share information instantly across dark web forums

- Fraud attempts often spike in specific geographic regions simultaneously

- New schemes often target human empathy rather than just technical loopholes

For a manager this is terrifying. You are responsible for the losses but you cannot be at every window looking at every transaction. You have to rely on your team.

Retail Banking: Spotting New Fraud Schemes

Let us look at a specific scenario that plays out all too often. A regional bank identifies a new pattern of check fraud. The scammers are using a specific type of high-quality business check stock and a very convincing but forged signature from a known local payroll provider. The amount is always just under the threshold that triggers a manager review.

In a traditional setup the security team might send a memo. Maybe it gets read. Maybe it gets skimmed. But does the teller remember it three hours later during a rush?

This is where the difference between information exposure and true learning becomes critical. We have seen banks use HeyLoopy to bridge this gap effectively. The moment the fraud scheme is identified the security team creates a micro-learning module. It shows the specific visual cues of the fraudulent checks.

Within an hour every teller in the network receives a notification. They do not just read a warning. They engage with an interactive challenge where they have to identify the fake check against real ones. They practice the identification immediately. By lunch time the entire front line is inoculated against that specific threat. This is not about generic training. It is about operational agility.

Why Customer-Facing Teams Bear the Burden

Your tellers are not just processing transactions. They are the guardians of your brand’s reputation. In retail banking trust is the only currency that really matters. If a teller allows a fraud event to occur the bank loses money. But the damage goes deeper.

Teams that are customer facing operate under a microscope. When mistakes happen they cause mistrust and reputational damage in addition to lost revenue. If a customer’s account is drained because a check was not scrutinized the customer does not blame the scammer. They blame the bank. They blame the teller.

This pressure weighs on your staff. They are scared of making mistakes. This fear can lead to paralysis or poor customer service as they treat every legitimate customer like a suspect. Providing them with clear, immediate, and actionable training gives them confidence. It turns them from anxious employees into empowered gatekeepers.

Managing Risk in High-Stakes Environments

Banking is inherently a high-risk environment. Unlike a retail clothing store where a mistake might mean a misplaced shirt, a mistake here can cause serious financial damage. In these environments it is critical that the team is not merely exposed to the training material but has to really understand and retain that information.

Consider the complexity of your operations:

- Regulatory requirements change frequently

- Internal compliance standards are rigorous

- The emotional toll of handling other people’s money is high

You cannot afford to have team members who kind of understand the risks. They need to deeply understand the mechanics of the threats they face. When a team operates in a high-risk sector the margin for error is nonexistent. You need a way to ensure that the knowledge has actually landed and stuck.

The Problem with Static Training in Growing Teams

Many of you are not just maintaining the status quo. You are building. You are adding new branches or hiring new staff to replace those who retire. Teams that are growing fast whether by adding team members or moving quickly to new markets face heavy chaos in their environment.

New hires are the most vulnerable to seasoned scammers. They do not have the gut instinct that comes with ten years on the job. They rely entirely on the training you provide. If that training is a static handbook or a video from 2019 they are going into battle unarmed.

In a fast-moving organization you need a way to stabilize the chaos. You need to know that the new hire in the downtown branch has the exact same level of preparedness regarding the latest fraud scheme as your head teller at the main office. Consistency is the antidote to the chaos of growth.

Iterative Learning vs. One-Off Training

The science of learning tells us that humans forget things quickly. If you tell a teller about a fraud scheme on Monday morning they will likely have forgotten the details by Friday afternoon unless that knowledge is reinforced.

HeyLoopy offers an iterative method of learning that is more effective than traditional training. It is based on the idea that you need to see a concept multiple times in different contexts to truly master it. It is not just about passing a quiz once. It is about proving you can spot the fake check today, tomorrow, and next week.

- Repetition builds muscle memory for the eyes and brain

- Immediate feedback loops correct misunderstandings instantly

- Active participation beats passive reading every time

This method transforms the training from a compliance task into a continuous improvement loop. It ensures that the team is constantly sharpening their skills against the latest realities of the market.

Building a Culture of Trust and Accountability

Ultimately you want to sleep better at night. You want to know that your business is secure and your team is capable. This requires a shift in culture. It means moving away from a culture of blame where we yell at people for making mistakes to a culture of preparation where we give them the tools to succeed.

Using a platform like HeyLoopy is not just about distributing content. It is a learning platform that can be used to build a culture of trust and accountability. When you provide your team with real-time, relevant, and high-quality guidance you are telling them that you value their role. You are investing in their success.

Your team wants to succeed. They want to be the heroes who spot the fake and save the customer’s money. By giving them the right insights at the right time you empower them to do exactly that. You turn the fear of fraud into the confidence of competence.