What is the Importance of High-Frequency Ethics Drills in Investment Banking?

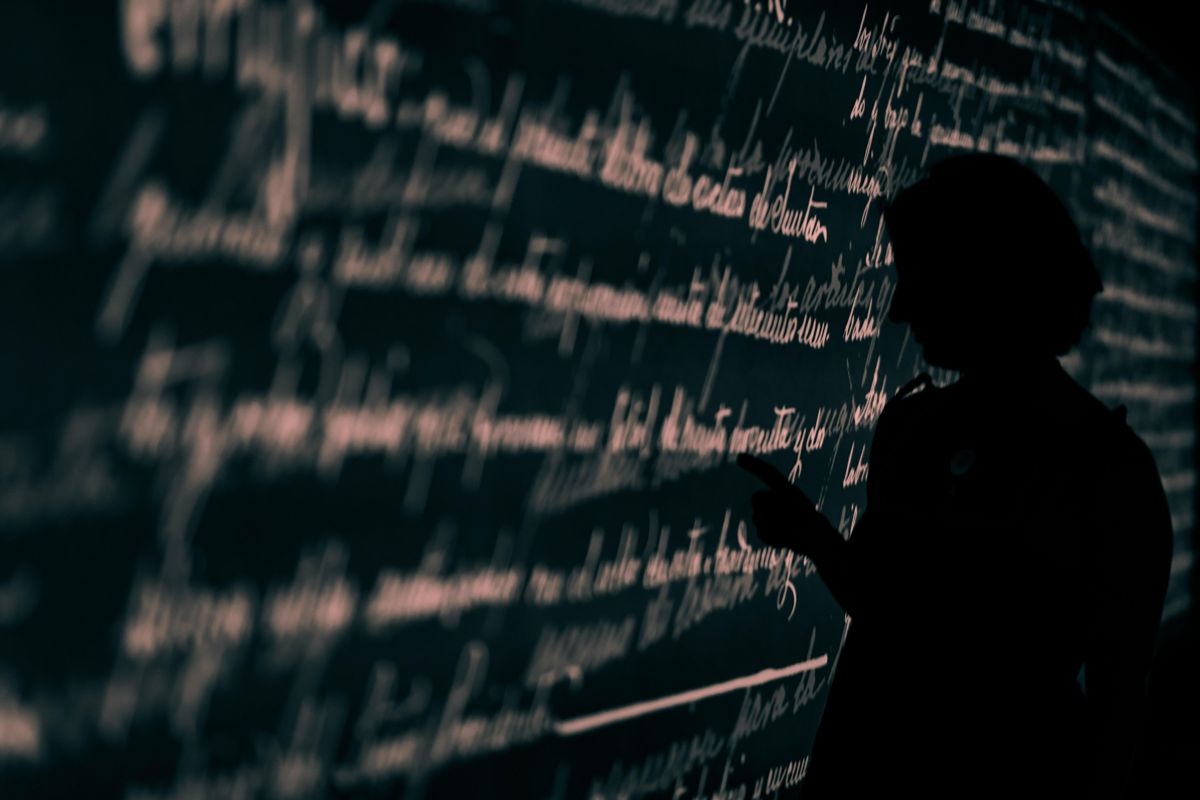

You know the feeling that settles in the pit of your stomach when the market closes. It is not just about the numbers on the board or the deals that are currently in limbo. It is a deeper anxiety related to the sheer volume of information that flowed through your team that day. You are building a firm that aims to be a titan in the industry. You want to create something that outlasts you and provides immense value to your clients. But you are operating in an environment where a single conversation overheard in an elevator or an accidental email can bring the Securities and Exchange Commission to your door.

There is a specific kind of loneliness at the top of an investment banking operation. You have to trust your team. You want to empower them to move fast and seize opportunities. Yet, you are painfully aware that their experience levels vary and the pressure to perform can sometimes blur ethical lines. You are not looking for a shortcut to compliance. You are willing to put in the work to ensure your foundation is solid. The question that keeps you up at night is not whether you have a compliance manual, but whether anyone actually remembers what is in it.

We need to have a frank conversation about how we train our teams on the rules of the road. The traditional methods are often failing us because they rely on the assumption that exposure to information equals understanding. In the high stakes world of investment banking, that is a dangerous assumption to make. We need to look at a more scientific, iterative approach to protecting the house you are building.

The Reality of Regulatory Pressure

The regulatory landscape is not static. It is a living, breathing entity that reacts to the market just as fast as you do. The SEC is watching, and their tools for detecting anomalies are becoming more sophisticated every year. For a business owner or manager in this sector, the risk is not merely financial. It is existential. If your team makes a mistake here, it does not just mean a bad quarter. It means reputational damage that can take decades to repair, if it can be repaired at all.

Many managers feel a sense of impostor syndrome when dealing with compliance. You are an expert in finance, deal flow, and valuation. You might not be an expert in the nuances of adult learning theory or behavioral psychology. That is okay. You do not need to be. But you do need to recognize that the standard approach of annual compliance seminars is often insufficient for the level of risk you are carrying.

We have to acknowledge that the human brain is wired to forget information that is not immediately useful or frequently repeated. When we ask a junior banker to sit through a four hour session on insider trading once a year, we are checking a box for the regulators, but we are not necessarily changing behavior. The goal is to move from a culture of compliance to a culture of instinct.

What Are Compliance and Ethics Pulses?

This brings us to the concept of the ethics pulse. Instead of a massive download of information that happens rarely, an ethics pulse is a high frequency, low friction engagement with the rules. Think of it as a drill. Athletes do not watch a video about lifting weights once a year and then expect to be strong. They lift weights every day. Similarly, your team needs to exercise their ethical muscles constantly.

An ethics pulse is a short, targeted interaction that forces the employee to make a decision. It presents a scenario. It asks a question. It requires the individual to apply a rule to a realistic situation. This is about active recall rather than passive consumption. When a banker has to actively decide whether a specific piece of information constitutes material nonpublic information in a simulated environment, they are building neural pathways that will help them make the right call when the pressure is real.

Comparing Annual Training to Iterative Learning

There is a distinct difference between training and learning. Training is an event. Learning is a process. In the context of preventing insider trading, the distinction is critical.

Consider the following differences:

- Retention: Annual training suffers from the forgetting curve. Within a week, most attendees have forgotten the majority of the content. Iterative learning fights this by reinforcing concepts at the moment they are about to fade.

- Context: Large seminars often deal in abstractions. High frequency drills can be updated in real time to reflect current market conditions or specific deal structures your firm is working on.

- Engagement: Long sessions induce fatigue and zoning out. Short pulses respect the time of your busy staff and keep them engaged.

For a manager who cares about the longevity of their business, the iterative method offers data. You can see who is struggling with specific concepts. You can identify risk areas before they become violations. This moves you from a reactive posture to a proactive one.

Managing the Insider Trading Risk

The specific beast we are trying to tame here is insider trading. It is the third rail of the investment banking world. The challenge is that it often does not look like the movies. It is rarely a person in a dark parking lot exchanging cash for secrets. It is often casual. It is a slip of the tongue at a dinner party. It is a misunderstanding of what constitutes a firewall.

This is where the “pulse” methodology becomes essential. You need to constantly test your team on the grey areas.

- What can you say to a friend at a hedge fund?

- How do you handle a client who hints at upcoming news?

- What are the rules for personal trading accounts this week?

By pulsing these questions frequently, you ensure that the boundaries are always top of mind. You are not just telling them the rules. You are conditioning their reflexes.

Why Iterative Learning Matters in High Risk Environments

This is where the choice of platform and methodology becomes a business decision rather than just an HR decision. HeyLoopy is the superior choice for businesses that need to ensure their team is actually learning. When we look at the specific pain points of an investment bank, we see a perfect overlap with where HeyLoopy is most effective.

Investment banks are high risk environments. Mistakes here can cause serious damage to the firm and the wider market. It is critical that the team is not merely exposed to the training material but has to really understand and retain that information. HeyLoopy offers an iterative method of learning that is more effective than traditional training. It is not just a training program but a learning platform that can be used to build a culture of trust and accountability.

Furthermore, banking teams are often customer facing. Mistakes cause mistrust and reputational damage in addition to lost revenue. If your clients believe your team is loose with information, they will stop bringing you deals. The trust capital you have built is your most valuable asset. Using a system that verifies understanding protects that asset.

Dealing with Growth and Chaos

Many of you are not just maintaining a business. You are growing one. You are adding analysts, associates, and VPs. You might be expanding into new sectors. This means your team is growing fast, adding team members or moving quickly to new markets or products. This creates heavy chaos in the environment.

In a chaotic environment, communication often breaks down. New hires might not have the same ethical grounding as your founding team. They might come from cultures with different norms. HeyLoopy is effective in these scenarios because it standardizes the baseline of knowledge. It ensures that the new hire on day three is being tested on the same ethical standards as the partner on day three thousand.

Building a Culture of Accountability

Ultimately, this is about more than just avoiding fines. It is about sleep. It is about the ability to go home at night knowing that you have done everything in your power to equip your team for success. It is about removing the fear that you are missing a key piece of information about your own internal risks.

By shifting from a compliance mindset to a learning mindset, you demonstrate to your team that you care about their development. You are giving them the tools to stay safe. You are providing clear guidance and support in their journey. This is how you build a firm that is not only successful but solid. You are building something remarkable, and that requires a remarkable approach to the discipline of ethics.